DET Voices #3: Saving For A Better Future

By Delta Electronics (Thailand) PCL. - Published November 15, 2020

Welcome to the third episode of DET Voices! This time we hear from four lovely female DET employees in Production, Training, Office Admin and Finance about how to save money for emergencies like COVID-19.

We all know that anything can happen in life, so we need to prepare well. Let’s hear what some of our women workmates have to say about the four questions we asked:

1. What percent of your income do you save every month and what is your biggest monthly expense?

2. How do you manage your family’s monthly expenses and savings?

3. What are your top 3 ways to save money at home?

4. Why are you saving money each month

Ms. Jantakon Jomboonsiri, DET5 Training

When we think about ways to save money, we must first look at our income. For example, I won’t spend more than I earn. We all may think we need an expensive house, a luxury car, etc. But, is this really possible for us to spend on personally?

We really have to think before we pay. We have to take part of the money we have and divide it up to see how much we need to spend on daily expenses. This is money we have to use. We should look at how much it costs to eat, for clothing, medical treatment and for savings. We have to divide this up in our budget before we start spending on whatever we want.

The main reason I’m saving money is that in my family we don’t have children. We'll have to plan our family finances far into the future because there will be no one to take care of us. So we need to do things such as saving money for life insurance, saving in bank deposits and saving for old age.

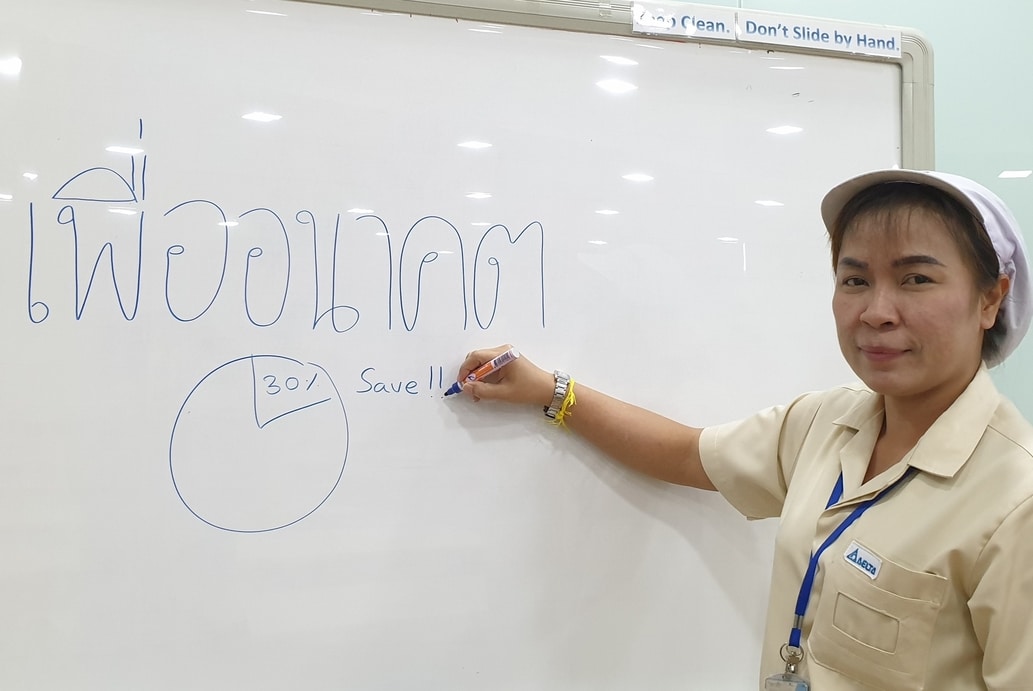

Ms. Patchanee Pairao, DET 5 Training

I always set aside 30% of my salary every month for savings.

There are a few reasons I save money each month. First of all, I need to save money to use in my old age so that it won’t make things difficult for my children who will be coming of age.

We'll set aside our money into four parts. The first part will be for our own personal expenses, the second part is to take care of my mother and my child, and the third part will be to buy life insurance to take care of myself when I get sick. The fourth part will be a monthly deposit which comes from 30% of my salary.

Ms. Sukanya K, Office Admin

First of all, it doesn’t matter how much we earn in a month, we should still think about making sure our main expenses are first deducted. After that, where will we keep the rest of the money? We should know this before using it to spend on other things.

The first thing to do is to have savings for eventual costs. By purchasing life insurance with a health insurance plan, you will save money spent in case of illness by having the money for this expense.

The second method of saving is making investments by buying LTF/RMF at the bank and investing in stocks. Although this is a kind of saving, you must accept some risk at the same time.

Both buying life insurance and buying investment units can also help us get a tax deduction each year.

The last way to save is to put your change in a simple money bank.

But remember that savings won’t help us at all if we do not manage our expenditures.

Ms. Chonlanee Nasom, Finance BFM

I save approximately 20-25% of my income each month.

I prefer managing my family finances using a monthly family budget. The first thing to do is to separate your savings and the amount you will spend. Don’t keep it in the same place. Once you’re finished, we have to divide the remaining money up. You can divide it into different expense categories. We have to pay fixed expenses every month and then there are costs that we can control such as daily expenses.

We must set a budget for how much we can use each day. Then we have to control ourselves so we don’t exceed our set budget. But in order to follow our plans, we need to have cooperation from all members of your family. This will help us have the savings we want that will be useful. We will also have more time for our families and be happier with ourselves with enough savings.